Bitcoin Transaction Energy Footprint - A Deep Dive

This Bitcoin criticism is actually… kind of correct? Let’s dive in:

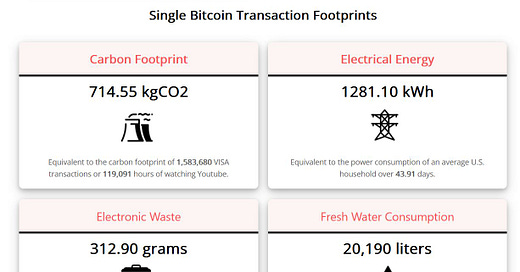

Bitcoin mining consumes roughly 100 TWh/year. On-chain, there are about 128 million transactions annually, leading to an energy usage of ~783 kWh/transaction (purely on-chain). Most Bitcoin transactions happen off-chain (e.g., Lightning Network, exchange internal transfers). If we add ~2 million off-chain transactions per day, the combined on-chain + off-chain total jumps—and the energy/transaction drops to about 116.5 kWh/tx.

These numbers can vary by a factor of 2–10, but they’re still within the same order of magnitude. Crucially, Bitcoin’s total mining energy (~100 TWh) is independent of both the number of transactions and the total value transacted. The security cost is effectively “fixed,” and more transactions or higher price simply amortize that cost over a bigger base.

kWh per $1 Million Transacted

On-chain USD volume:

$8 billion/day × 365 ≈ $2.9 trillion/year.

That’s 34,500 kWh per $1 million if you only count on-chain.

Factoring in off-chain:

If total volume is 5× larger (Lightning, exchanges), it’s about 6,850 kWh/$1M.

If BTC hits $1 million:

Assume daily volume scales with price; that could bring it down to ~685 kWh/$1M.

If off-chain usage is 100× bigger than current:

The cost might drop to ~7 kWh/$1M. (About $1 in electricity in the USA)

In short, Bitcoin’s “energy per dollar transacted” hinges heavily on adoption and price. The more people move off-chain or the more the price/volume goes up, the more you spread that fixed security cost over a larger base.

Comparing Gold’s Energy Use

Gold’s industry: ~240 TWh/year for mining, refining, storage, etc.

Global gold transactions: Some estimates put annual transaction volume near $20 trillion.

kWh per $1M for Gold: ~12,000 kWh/$1M.

That’s in the same ballpark as Bitcoin, especially if you include second-layer BTC usage. Moreover, physical delivery of gold (true final settlement) is far more cumbersome than sending BTC on-chain, which grants final settlement with each block. Paper-gold trading is large, but not actual physical movement—whereas Bitcoin’s base-layer settlement is physical in the sense of being irreversible proof-of-work for every single transaction.

Bottom Line

Bitcoin On-Chain: ~783 kWh/tx and ~34,500 kWh/$1M.

Bitcoin + Off-Chain: As low as ~116.5 kWh/tx and ~6,850 kWh/$1M (or much lower if price and adoption keep scaling).

Gold: ~12,000 kWh/$1M, but that’s mostly “paper” settlement; physically moving gold is far more expensive than Bitcoin.

Who wins? It depends on how you count off-chain BTC usage and whether you treat digital/paper gold as “settlement.” But either way, both systems land within an order of magnitude when you look at total energy use vs total value transferred. And only Bitcoin offers an easy path to final settlement in each transaction.

Why This Entire Analysis Is Nonsense:

Bitcoin aims to be a store of wealth and medium of exchange—a “rising monetary asset.” If you believe Bitcoin will fail, you wouldn’t invest, and the cost per transaction isn’t worth it. If you believe Bitcoin will become a global reserve asset, it’ll secure a chunk of the $500T in global wealth.

Now consider how much energy people spend to guard wealth under fiat: banks, vaults, yachts, resource-driven wars, plus the economic destruction from inflation and high time preference. Millions died in wars fought over control of money and resources. All told, this is the real cost of securing wealth that Bitcoin can replace. Because Bitcoin’s security cost doesn’t scale with price or volume—if (IF!) Bitcoin wins, its energy footprint is a tiny fraction of what the fiat system consumes.